Washington has reopened

As of June 30, Washington has moved past Governor Inslee's "Roadmap to Recovery" plan, and all businesses are able to return to normal capacity and operations. Masking requirements for the state will continue to abide by guidelines established by the Centers for Disease Control and Prevention.

The only limitation that will still be in place following the June 30 reopening applies to large indoor events, which are defined as any event with more than 10,000 simultaneous participants in an enclosed space. The state will still restrict these events to 75% capacity unless all attendees are vaccinated. The restrictions will be reevaluated on July 31.

Get the Word Out About Your Business

Inlander Fresh Sheet

The "Fresh Sheet" is a free promotional tool by The Inlander for Inland Northwest hospitality-focused businesses to keep the public aware of what your business is up to. New submissions will be published on their "Back to Business" site, and also published each week in the Back to Business pages in The Inlander (as space allows).

You can come back as often as you would like and submit your business's deals, specials and business updates as they change. Click the button below to be included in their promotions.

Live Local

"Live Local" is a ‘buy local’ education campaign that will make it easier for consumers to

safely patronize local businesses while pandemic restrictions are in place. The program aims to increase revenues at locally-owned businesses to help keep independent businesses open and preserve local ownership in our regional economy, both during the effects of COVID-19 and for years to come. The Live Local Marketplace will launch in mid-October, giving Spokanites a one-stop shop for the best local businesses.

Through Oct. 15 Live Local is also offering free business consulting and webinars.

Register to the Marketplace and sign up for free business consulting.

Save 509

The Spokane Hospitality Coalition (SHC), is a cooperative effort of city and county officials working alongside local bars and restaurants to keep our local business' doors open. The SHC's sole mission is to keep our community safe and save local business. Every member of the SHC has agreed to follow improved guidelines, procedures and regulations in order to keep our employees & customers healthy and our doors open.

How are you Doing?

InlandBizStrong has created an anonymous questionnaire for business owners to get the resources that their business’ unique circumstances warrant. Get started by clicking below.

Financial Help

City of Spokane Business Resilience Loan Program

The City of Spokane's Community, Housing, and Human Services Board is investing funds to help small businesses stay resilient in the economic impact of the COVID-19 pandemic. The funding, which comes from federal Community Development Block Grant (CDBG) dollars, will provide eligible Spokane businesses with access to affordable loans through a partnership with non-bank community lender Craft3.

The Main Street Lending Program

The Main Street Lending Program (MSLP) provides cash flows to small and mid-sized businesses with the purchase of up to $600 billion in loans originated by U.S. banks, their holding companies, and credit unions. The MSLP implements provisions under Title IV of the CARES Act and is intended to supplement the Paycheck Protection Program (PPP) designed to target small businesses. Borrowers that have taken advantage of the PPP may also take out MSLP loans.

Summary courtesy CliftonLarsonAllen LLP

Small Business Hardship Utility Bill Assistance

Through the City of Spokane, businesses can seek a deferral of one to three months of City charges for water, sewer, stormwater and garbage with an agreement to pay those charges over six to 12 months without interest. Specific terms would be tailored for each business seeking a deferral. Assistance is available immediately.

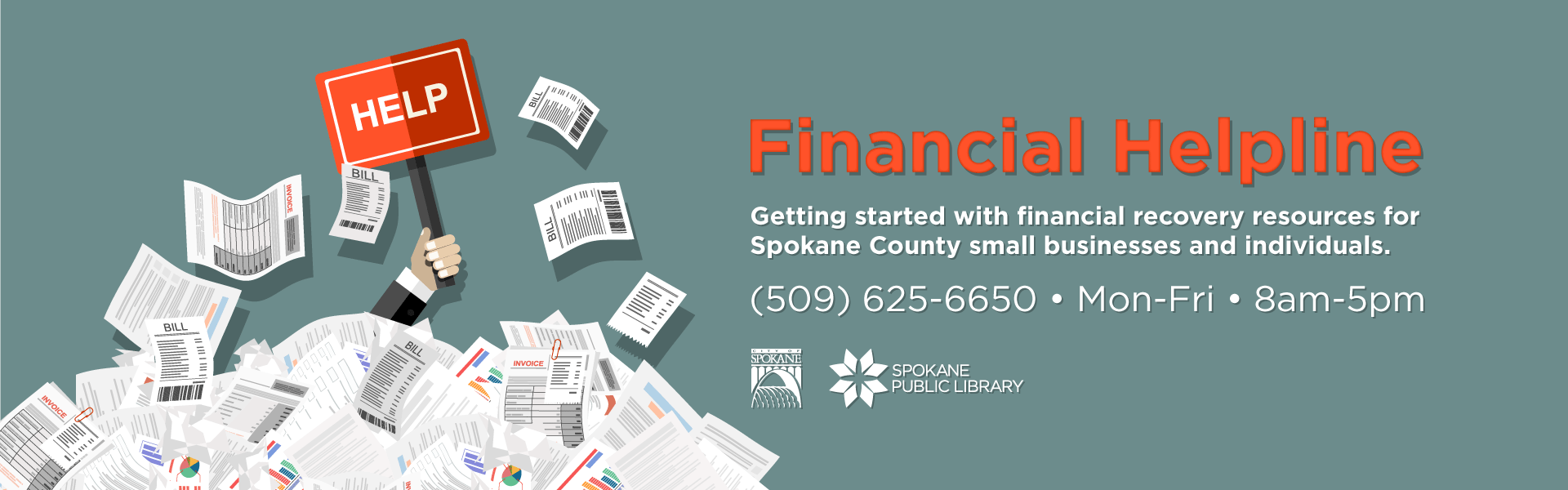

As part of the regional effort to recover from the economic impacts of COVID-19, the City of Spokane is partnering with Spokane Public Library to provide a Financial Helpline for all businesses and individuals countywide trying to access COVID-19 financial recovery programs. Call 509.625.6650, Monday-Friday, 8:00 am to 5:00 pm.

While we are all eager to return to the bustling downtown we knew before COVID-19, we will all have to continue to take extra precautions in order to prevent the spread.